Locations

Last updated: 23/02/2023

The UK merger control regime is one of the few voluntary, non-suspensory filing regimes in the world. If a transaction meets one of the relevant thresholds, there is no requirement to notify, but the UK Competition and Markets Authority (the "CMA") does have jurisdiction to investigate the transaction and impose remedies to address any substantial lessening of competition which may arise as a result.

Below we take a look at current trends in relation to the investigations carried out by the CMA and the related outcomes from April 2022 to date.

UK merger control stats

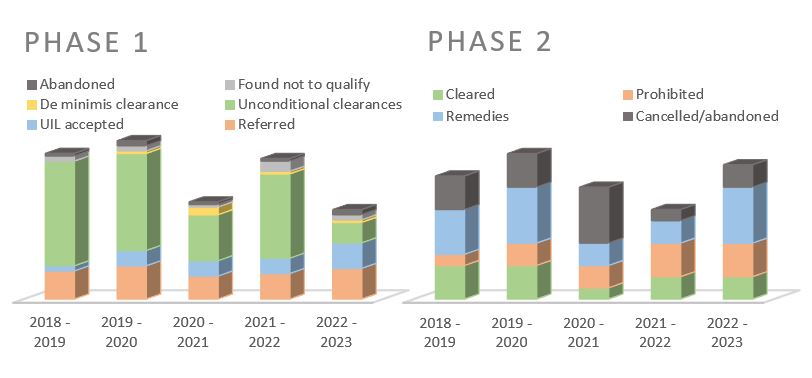

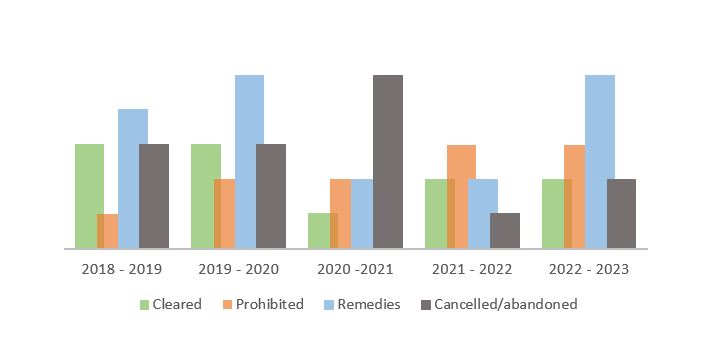

In our last update, we noted that the CMA had launched 13 new merger investigations during the period from April to August 2022, covering a variety of sectors, including the supply of chemicals, sports rights joint ventures, and video games. Since then, the CMA has launched further 22 investigations, with a focus on transport, energy and natural resources sectors. With just over a month remaining in the financial year, the CMA is unlikely to surpass the number of Phase 1 decisions recorded between April 2021 and March 2022, but its activity at Phase 2 is expected to return to pre-pandemic levels.

Between April and August 2022, no transaction had cleared unconditionally at Phase 1; eight have now done so. Yet, this number remains far below the 33 unconditional clearances recorded between April 2021 and March 2022. On the other hand, there has been a notable increase in the number of transactions cleared at Phase 1 subject to conditions: this category of cases has gone from six to ten.

Now more than ever, the CMA seems inclined to accept undertakings in lieu (UIL) of reference to Phase 2. Following a Phase 2 investigation, divestiture remedies are still far more common than behavioural remedies: since April 2022, the CMA has imposed divestiture remedies on five occasions and there have been no behavioural remedies agreed at Phase 2. Between April 2021 and March 2022, the CMA imposed divestiture remedies at Phase 2 on only two occasions. This is a significant increase, which might suggest a greater appetite on the part of merging parties to argue their case at Phase 2 (and possibly secure unconditional clearance).

While the UK merger control regime is voluntary, in practice, many parties do pre-notify the CMA, because there can be significant risks of not doing so. The CMA can investigate any transaction within its jurisdiction on its own initiative, and can make a reference for a Phase 2 investigation up to four months after the merger becomes public or after closing, whichever date is later. This can cause significant cost, delay and integration obstacles for the merging parties.

It is, therefore, often advisable to engage with the CMA, whether via a confidential briefing note or a full notification, particularly where the proposed transaction might arguably raise some substantive competition concerns.

If you are subject to, or an interested party to, an investigation, we have extensive experience in market studies and investigations across the UK and Europe, and our knowledge of regulators’ processes and priorities mean that businesses can rely on our advice about the types of analysis, evidence, and arguments that will have the greatest impact.